Section: 523-12.3

Effective: 01/11/1982

Supersedes: 02/10/1974

Next Review Date: TBD

Issuance Date: 01/11/1982

Issuing Office: Procurement & Contracts

LEASE OF EQUIPMENT

I. REFERENCES AND RELATED POLICIES

A. Business and Finance Bulletin (BFB)

|

Management and Control of Inventorial Equipment |

|

|

Materiel Management |

B. Systemwide Accounting Manual

|

Accounting and Reporting for Leases and Installment Purchase Contracts |

C. UCSD Policy and Procedure Manual (PPM)

|

10-5 |

Delegation of Authority |

|

University of California Basic Purchasing Policy |

|

|

523-5 |

How to Write a Purchase Requisition |

|

Authority to Solicit Quotations, Release Award Information, and Execute Purchase Orders/Contracts |

D. Hospital Instruction Manual (HU)

|

410.1B |

Rental & Lease Equiptment |

E. Federal Government Regulations

Office of Management and Budget Circular No. A-21, Para. J.33, entitled, "Rental Costs of Buildings and Equipment"

II. DEFINITIONS

A. Straight Lease or Rental Agreement

A written contract executed by the University (lessee) and another party (lessor) containing the essential terms and conditions for the use or possession of personal property by the University in exchange for scheduled payments of specific amounts of money during the life of the contract. At the end of the contract, the property is returned to the lessor in a condition and at a place as agreed to by the parties. Title remains with the lessor.

Another name sometimes used for a straight lease is a "Closed-end Lease".

B. Lease with Purchase Option

A written contract executed by the University (lessee) and another party (lessor) containing the essential terms and conditions for the use or possession of personal or real property by the University in exchange for scheduled payments of specific amounts of money during the term of the contract which gives the lessee the option to purchase the property either during the life of the lease or at its expiration. All or a portion of the lease payments may apply toward the purchase of the property as stated in the contract. Title remains with the lessor until the purchase option is exercised.

A variation of Lease with Purchase Option is "Open End Lease". Lessee normally has the right, but not the obligation, to pay the guaranteed amount and take title to the item.

C. Lease/Purchase (Installment Purchase Contract)

A written contract executed by the University (buyer) and another party (seller or third party) containing all the terms and conditions for the acquisition of personal property by means of scheduled installment payments of specific amounts of money during the life of the contract. Title remains with the seller until the total contract amount has been paid, but the University has use and possession of the property during the life of the contract.

Third party leases are available through banks and commercial leasing companies. Most third party lessors have no real interest in the equipment, do not include maintenance in the lease, and are not expert in the operation of equipment. The lease is written with the expectation of the lessee owning the equipment at the end of the lease period.

III. BACKGROUND

A. Lease or Buy

Private industry has become increasingly aware of the advantages of renting or leasing capital equipment in lieu of outright purchase. Many of the considerations which influence the "lease or buy" decision in private enterprise can be applied to non-profit public institutions.

If a feasibility study has been completed, and a vendor and a specific configuration of equipment have been selected; the decision then to be made normally involves three alternatives:

1. Rental or "straight" lease.

2. Leasing the equipment (usually direct from the manufacturer) with purchase option.

3. Outright purchase, which may be done directly or under an "installment payment" sales contract.

The primary determinant of this decision should be economic; for example, lowest cost. It is generally conceded that outright purchase is the best alternative in most cases; leasing direct from the manufacturer with purchase option is second-best; and rental (straight lease or closed-end lease) is an alternative which is rarely economically viable.

If leasing presents the most viable alternative under the circumstances (see Paragraph B immediately below), then the lease should be negotiated in such a manner as to protect the University to the end that (1) the University has the right to terminate at the end of the contract / grant / or other funding cycle; (2) the residual value of the equipment at that point in time is equal to or greater than the net unpaid balance under the lease; (3) the University has the right to terminate during the initial term of the lease, should the funding agency prematurely terminate the contract/\%grant (however, the University should insure that the sponsoring contract / grant agency would view any penalties for premature termination as an allowable cost); and (4) if continued for the duration envisioned at the outset, the University would be in the favorable position of being able to take title to the equipment with only nominal or zero capital outlay at the end of the lease period.

B. Other Important Consideration of Lease versus Purchase

|

LEASE |

PURCHASE |

|

1. The lease can be as flexible as the University requires.

2. Availability from lessor of equipment maintenance.

3. Obsolescence; relatively short term nature of lease obligation accommodates situations of technical obsolescence and physical deterioration to benefit of the University.

4. Where the suitability of the equipment for a particular purpose is uncertain, the expense of a purchase is saved in the event the equipment is ultimately not found suitable.

5. Short-term needs can be satisfied by such arrangement. |

1. Assuming cash availability, outright purchase is lower in cost. |

C. Lease Financing

Lease financing is negotiable. Some manufacturers lease directly or through a subsidiary at reasonable rates as an incentive to buy their product. Independent leasing company rates are usually the highest. Installment purchase contracts through banks are at a lower interest rate than through commercial sources.

The University of California enjoys lower bank interest rates than private enterprise because it is a public entity. The bank receives tax credit when monies are loaned to State and local governments.

The Purchasing Division is charged with the responsibility of negotiating lease financing rates and is in a position to advise departments in this matter during the "lease or buy" decision making phase.

Each proposed lease financing interest rate, irrespective of the source, must be approved by the Treasurer of the Regents.

When leases are negotiated using Federal funds (grants, contracts, and other agreements), rental costs are allowable only up to the point that would have been allowed had the University purchased the property on the date the lease agreement was executed.

IV. PROCEDURE

A. Originating Department

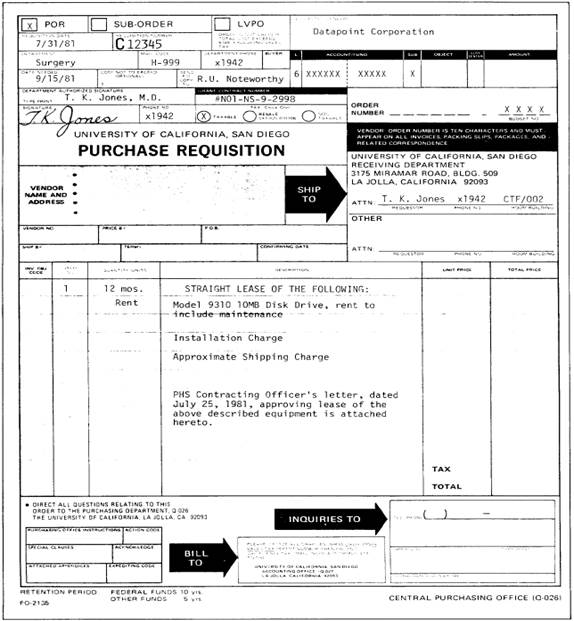

The Purchase Requisition, FO-2056, Exhibit A, is the authorization by which the Purchasing Division can commit departmental budgets to lease expense. All procedures, restrictions, and/or required approvals contained in the references mentioned above, are also applicable to Purchase Requisitions covering leases. In addition to the usual information required (see PPM 523-5), the Purchase Requisition should include:

1. Name of the manufacturer of the equipment.

2. The length of anticipated use of the equipment (from which the Purchasing Division can then determine the length of the lease);

3. Full and complete description of property to be leased; and

4. Description of the funds available for payment and when funds expire. Attach copy of any appropriate approval(s) from funding agency.

5. Portions of the following checklist for Purchasing includes items which are asterisked (*) and which should be initially considered by the department in deciding to lease or buy.

B. Purchasing Division

1. Select lessor company after completing required competitive processes. Negotiate terms and conditions of lease acceptable to both parties. Insure that all essential matters are included such as indicated by the following checklist:

a. Date of execution of lease.

b. Name in full and address of lessor.

c. Name in full and address of lessee.

d. Business activities of parties, where material.

*e. Description of leased property, including serial numbers of the equipment and of any component parts.

*f. Use to be made of leased property, and limitations on removal from location of use.

g. Type of lease. It is important the type of lease be shown on the Purchase Order for internal accounting purposes.

*h. Period of lease.

i. Amount, method, place and time of payment of rental (as provided in the amortization schedule if a conditional sales contract).

j. Provision for sales/use tax (It is noted that normally sales or use tax is applicable regardless of source of funds and is paid by the lessor but recovered from the lessee as part of the rent).

*k. Any warranties by lessor.

l. Title to leased property.

m. Appropriate indemnification provisions.

*n. Insurance on leased property, if appropriate. If equipment is easily portable, insurance is highly desirable even though lessor may not require it.

*o. Provision for maintenance of leased property, and to what extent, if any.

*p. Liability for damages to or loss or destruction of property during lease period.

*q. Stipulation as to loss value.

r. Lessee's right to sublease, if appropriate.

s. Provision for return of leased property at end of term.

*t. Purchase option(s), including option purchase price(s), time limitations and method of exercise.

u. Rights and duties of parties following breach of lease agreement.

v. Renewal of lease.

w. Determination of applicable state law to govern the lease agreement.

x. Signature of the lessor and lessee.

2. Purchasing Division obtains necessary approvals prior to execution of the lease, including approval of legal form by General Counsel, Treasurer's approval of interest rate and the UCSD Accounting Officer's Certificate of Availability of Funds.

V. RESPONSIBILITIES

A. Department Chair and Other Departmental Personnel with Requisition Signature Authority

Shall not execute any rental agreement or lease in the department but shall refer all terms and conditions that may be presented by any prospective lessor to the Purchasing Division, usually with Purchase Requisition, FO-2056.

B. Custodian of Leased Property

1. Inspect equipment upon receipt and acknowledge it to be in good condition.

2. Use ordinary care for its preservation during the period of possession and repair all damage occasioned by want of ordinary care. At the end of the lease, insure that the property is available for return in the same condition as received, less normal wear, tear, and depreciation.

C. Purchasing Division

1. Negotiate price(s) and make final determination of terms and conditions applicable to the lease and be responsible for contents and execution of all contractual documents.

2. Report all insurance requirements to the Business Office in sufficient detail to obtain necessary insurance coverage at departmental expense.

3. Maintain contract administration control over each lease for its contractual life.

D. Inventory Division

Assign the correct object code applicable to the type of lease indicated on the Purchase Order.

E. Accounting Office

1. Approve availability of funds upon request of Purchasing Division.

2. Prepare and submit the Annual Lease Report to Systemwide.

3. Prepare and submit the Financial Position Report - Debt Obligations and Leases to Systemwide Quarterly or as directed.

EXHIBIT A