Section: 395-11

Effective: 01/01/1991

Supersedes: 09/28/1978

Next Review Date: TBD

Issuance Date: 01/01/1991

Issuing Office: General Accounting Division

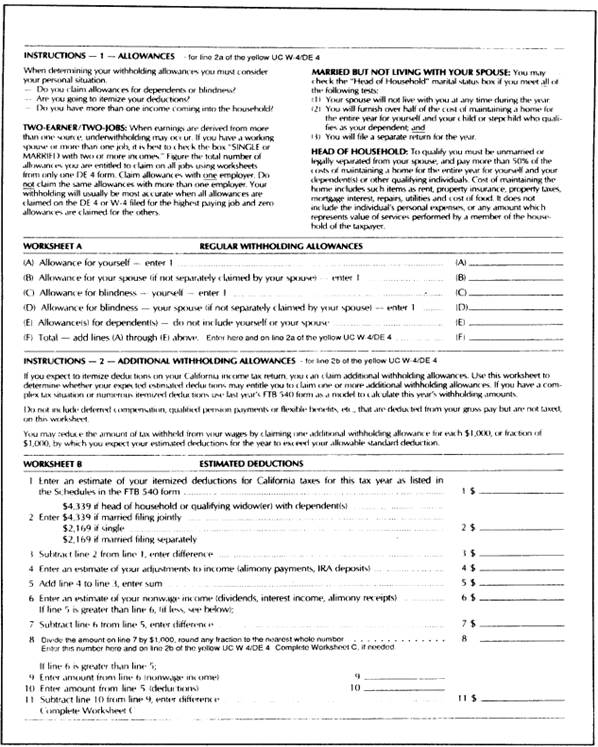

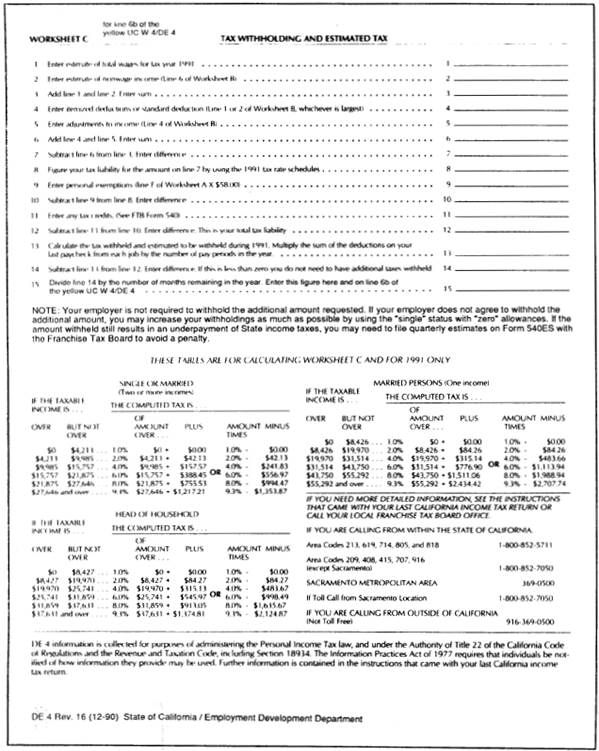

PPM 395-11 Exhibit A [pdf format]

PPM 395-11 Supplement I [pdf format]

PPM 395-11 Supplement II [pdf format]

FEDERAL & STATE-WITHHOLDING TAXES

- REFERENCES AND RELATED POLICIES

- Internal Revenue Code

- Internal Revenue Service Publication 15, Circular E

- Payroll Guide, Volume 1, Section 5

- Internal Revenue Service Publication 518, Foreign

Scholars and Educational and Cultural Exchange Visitors, 1989 Edition

- DE 44, Employer's Tax Guide, State of California

- Federal Privacy Act 1974

- University of California Accounting Manual

|

Payroll: Federal Taxation of Citizens |

|

|

|

|

|

Taxes: Federal Taxation of Aliens |

- UCSD Policy and Procedure Manual (PPM)

|

Alien Information |

- DEFINITIONS

- Employer

An employer

is a person or organization for whom an individual (as opposed to a corporation

or other legal entity) performs a service as an employee.

- Employee

Anyone performing

services subject to the will and control of an employer, both as to what shall

be done and how it shall be done, is an employee. This applies even if the employer

permits the employee considerable discretion and freedom of action, if the employer

has the legal right to control both the method and the result of the services.

- Taxpayer Identifying Number

In

compliance with Federal Income Tax regulations, the University is required to include

an identification number on all statements and reports of wages paid and taxes

withheld. For payments to individuals, Federal regulations have designated the

Federal Social Security number as the taxpayer's identifying number. Therefore,

the Federal Social Security number, issued by the Social Security

Administration, must be obtained from each person receiving payment(s) from the

University.

- POLICY

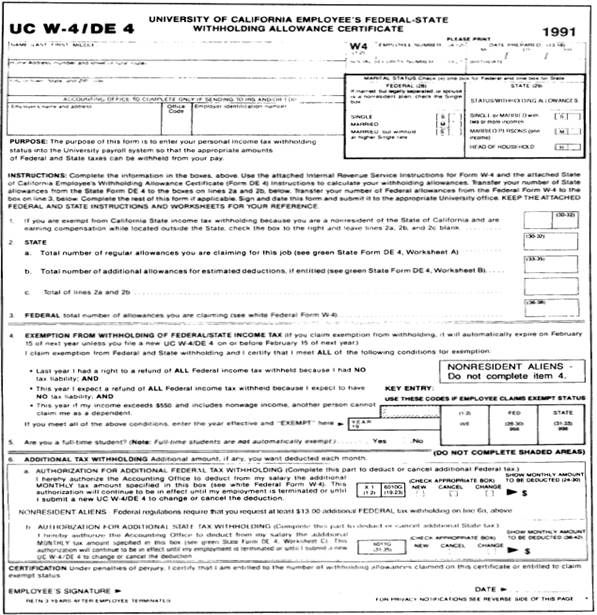

- Federal and State Withholding

The University

is required by both Federal and State statutes to withhold appropriate taxes

from payments made to individuals. Failure to collect or pay tax withheld will

result in the University being liable for the tax due plus penalties. Income

tax withholding is based upon information submitted by the employee on a University

of California Employee's Federal-State Withholding Allowance Certificate,

UC W-4/DE 4, Exhibit A. Marital status and the number of

withholding allowances claimed on the UC W-4/DE 4 are taken into account when

computing taxes. The law provides that if no UC W-4/DE 4 is submitted, the

employer must withhold taxes at the rate for a single person claiming no

exemptions. Certain employees may qualify to claim an exemption from tax

withholding by completing item #4 on the UC W-4/DE 4, Exemption from

Withholding of Federal/State Income Tax, and item #5. These are the only two

items that are to be completed when an employee is claiming exempt from tax

withholding. To qualify the employee must certify 1) that no income tax

liability existed in the prior taxable year, 2) that none is anticipated for

the current year, and 3) that if the employee's current yearly income exceeds

$500 and includes non-wage income, another person cannot claim the employee as

a dependent. Note: Employees claiming exempt from withholding, who are earning

in excess of $200 per week and answering ``NO'' to item #5 on the UC W4/DE 4

form will have a copy of the UC W4/DE 4 sent to the Internal Revenue Service.

- Social Security

Social

Security is deducted from those employees who are members of the University of

California Retirement Plan (UCRP) and who:

- Were members of the system prior to April 1, 1976 and

elected Social Security coverage, or

- Became a member of the system after April 1, 1976.

Social

Security is also known as "FICA". The term "FICA" is an

acronym for Federal Insurance Contributions Act which is comprised of two

components: Medicare Tax and OASDI (Old Age Survivors and Dependents Insurance)

Tax.

Generally

the only exception to this policy is nonresident aliens admitted to the United

States on an F-1 (student admitted to attend a specific school) or J-1

(exchange visitor engaged in a Department of State approved program for study,

research, or training) visa.

- Defined Contribution Plan/Safe Harbor Plan

The Defined

Contribution Plan, also known as the Safe Harbor Plan, is an alternative to

Social Security Tax participation. This plan is an employer- sponsored

retirement plan which provides for benefits that are generally equal to the

pension benefit provided under Social Security. Participation in the plan is

open to those employees who do not otherwise qualify for membership in the

University of California Retirement Program (UCRP) or another defined benefit

retirement plan in which the University participates. Nonimmigrant aliens with

F-1 or J-1 visa status and employees who are registered UC students are not

eligible to enroll in this plan as they are exempt from paying FICA taxes.

Eligible

employees may elect to enroll in the Defined Contribution Plan (DCP) or elect

to pay Social Security taxes at the time of the initial appointment. Once an

election is made, the election is irrevocable for the duration of the

employee's continuous employment with the University.

Eligible

employees who were hired on or after 4/1/86 and elect to enroll in the Defined

Contribution Plan/Safe Harbor Plan will have a 7.5% pretax DCP

deduction taken from his/her salary and will pay the 1.45% Medicare tax.

Eligible employees

who were hired before 4/1/86 and elect to enroll in the Defined Contribution

Plan/Safe Harbor Plan will also have a 7.5% pretax DCP

deduction but will not be required to pay the 1.45% Medicare tax.

Eligible

employees who choose not to enroll in the Defined Contribution Plan and elect

to pay the OASDI will become subject to the Medicare tax, regardless of the

hire date.

- PROCEDURE

- Taxpayer Identifying Number (Social Security Number)

The

employing department will require each new employee to furnish his/her social

security number which is recorded in the appropriate section of the UC W-4/DE 4

Form. The disclosure of the social security number is mandatory pursuant to

Federal and State codes and conforms to the Federal Privacy Act of 1974. If the

employee indicates that he/she does not have a social security number, the

hiring department will instruct the individual to apply for one at a Social

Security Office. Until a valid social security number or a receipt for

application for a social security number is received, the employee's forms for

employment will not be processed. Note: The Social Security Office nearest to

UCSD is located at 1940 Garnet Avenue, Suite #207, which is in Pacific Beach.

The office is open Monday through Friday from 9:00 a.m. to 4:30 p.m. The

general information phone number is (619) 483-7646 or 1- 800-234-5772.

- Withholding Tax

- United States Citizen

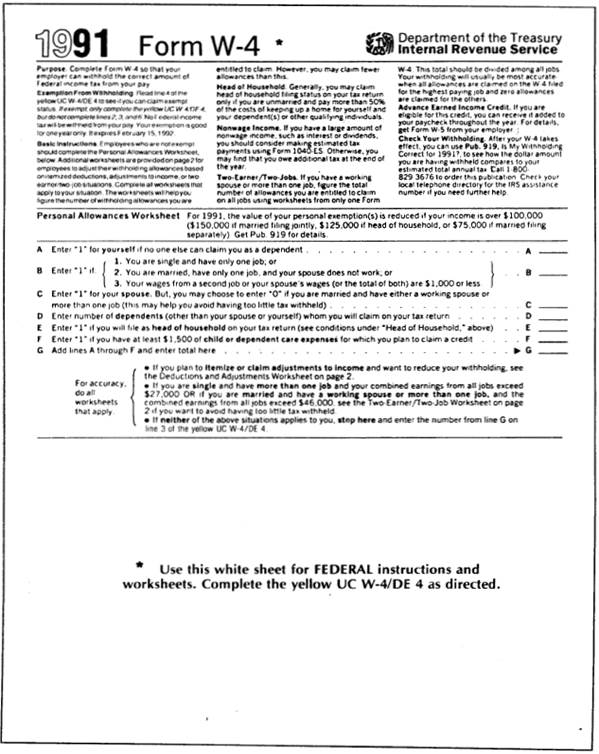

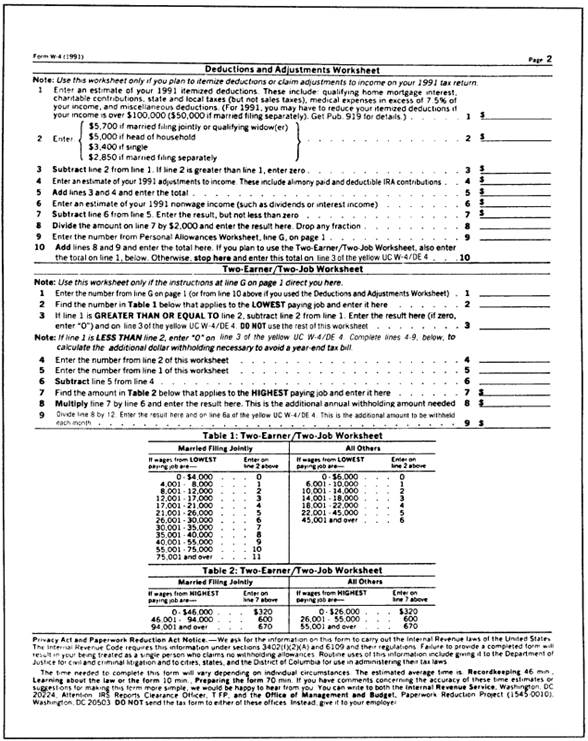

Employees

determine the amount of tax withheld from their earnings by filing with the

Accounting Office/Payroll Division a University of California

Employee's Federal-State Withholding Allowance Certificate, UC W-4/DE 4,

indicating the number of exemptions claimed. Based upon the Certificate, the

payroll system will calculate and withhold Federal and State taxes from employee's

payroll checks. (See Supplement I and II for

tables to calculate approximate taxes to be withheld.) If an employee has

reduced his/her exemptions to zero to allow for maximum tax to be withheld and

their liability is still not satisfied, an additional amount per pay period can

be requested by the employee. (See Item #6, Exhibit A, Page 1.) The number of

exemptions claimed for withholding purposes need not be the same number of

exemptions which may be claimed on the employee's annual tax return. Employees

with a sizeable amount of itemized deductions may claim additional withholding

exemptions to reduce the amount of tax withheld thereby reducing an anticipated

large tax refund at the end of the taxable year. The number of additional

exemptions may be determined by completing both sides of the enclosed attached

worksheet Form W-4, Exhibit A, Pages 2-3, and Form DE 4, Exhibit

A, Pages 4- 6. Those employees indicating in excess of 10 (ten) Federal

and/or State exemptions on their UC W4/DE 4 form will have a copy of their form

sent to the IRS and/or State of California Franchise Tax Board.

- Aliens

- Resident Aliens

Aliens who

qualify under the Substantial Presence Test as resident aliens may claim residence

for tax purposes. (Refer to PPM 395-13 for qualifying conditions.) Federal and

State taxes will be withheld in the same manner as a United States citizen.

(See Section B.1. above.)

- Non-resident Aliens

Aliens who

do not qualify as resident aliens under the Substantial Presence Test are

considered as non-resident aliens. The earnings of a non-resident alien are

subject to withholding at the same rate as a single United States citizen

claiming one exemption regardless of the number of actual exemptions the

individual might wish to claim, except for residents of Canada, Mexico, South

Korea and Japan. Some non-resident aliens may be eligible for exemption from

Federal tax withholding if they qualify according to the terms of a tax treaty

between their country of residence and the United States. To determine the

eligibility of an alien, departments should contact the Accounting

Office/Payroll Division and request a review of the tax treaty. Note: a tax

treaty exemption applies only to Federal taxes, and does not exempt an

individual from State tax withholding. (Refer to PPM 395-13 for additional

alien information.)

- Annual Statements

- Wage and Tax Statement, Form W-2

Forms W-2

are issued to employees on or before January 31st of each year for earnings

paid in the preceding taxable year. The information contained on the form is

the total earnings and taxes withheld that were reported to both Federal and

State Agencies. The statement also includes any additional non-salary payments

issued to an employee through the University system. These payments include but

are not limited to stipend payments and uniform allowance.

- Income Subject to Withholding Under Chapter 3,

Internal Revenue Code, Form 1042S

Forms 1042S

include salaries and miscellaneous payments made by the University to

non-resident aliens who have claimed exemption from Federal tax. These

statements are issued on or before March 15th of each year.

- Statement for Recipients of Miscellaneous Income,

Form 1099

Form 1099 is

issued to individuals who are not employees of the University. The statement

indicates the total non-payroll payments issued. These non-payroll payments

include but are not limited to rents, fees, and payments to independent

contractors and consultants. The statement is released on or before January

31st of each year.

EXHIBIT

A

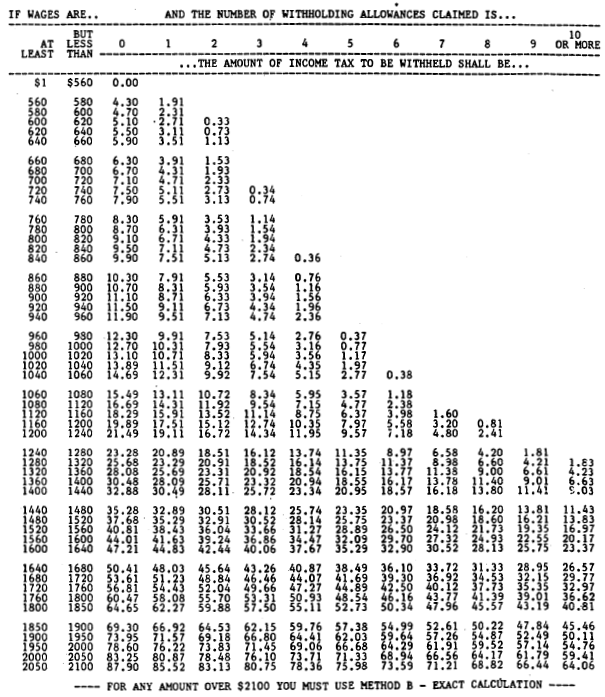

SUPPLEMENT I

FEDERAL INCOME TAX

WITHHOLDING RATES

Effective January 1, 1993

INSTRUCTIONS:

MONTHLY RATED EMPLOYEES:

EXAMPLE:

A married employee,

earning $4,967 per month, with $50/month tax shelter. Employee has spouse and

two children, also claims three allowances for itemized deductions. Spouse not

working.

4 Exemptions for family

members

3 Allowances for

itemized deductions

7 Exemptions on Form

UCW-4, Line 3

Step 1:

From the

taxable gross (after deducting tax shelter, TSP, retirement) deduct $195.83 for

each withholding allowance claimed on line "3" of the Form UCW-4 to

obtain the adjusted taxable gross.

$ 4,967.00 Total Gross

(

70.34)

Retirement Reduction

( 50.00)

Tax Shelter Savings

4,846.66 Taxable

Gross

(1,370.81) $195.83 x 7

Exemptions

3,475.85 Adjusted

Taxable Gross

Step 2:

Using the

appropriate attached table for marital status and pay period, seek the adjusted

taxable gross (determined in Step 1) range in the two left columns.

Married

Employee, paid monthly, range is

$3,396 - $6,771 ... $431.85 plus 28% of excess over $3,396

Step 3:

Deduct the

range minimum in the right column from the adjusted taxable gross and multiply

the difference by the percentage indicated.

3,475.85

Adjusted Taxable Gross

(3,396.00) Range

Minimum

79.85

Excess

X 28%

Tax Bracket

22.36

Subtotal

Step 4:

Add the

fixed dollar amount (if tax rate is more than 15%) to the amount calculated in

Step 3. This is the amount of Federal Tax.

431.85

Fixed Amount

23.36

Subtotal

454.21

Federal Tax to Withhold

HOURLY RATED EMPLOYEE:

Use the

same procedure as above, except deduct $90.38 for each deduction in Item 1.

1993

SOCIAL SECURITY/UCRS WAGE BASES

The Revenue Reconciliation Act of 1990 provides different wage

base caps for the OASDI and Medicare components of the social security tax.

Effective with earnings paid on or after January 1, 1991, the OASDI and

Medicare wage base will increase. The tax rate percentages remain unchanged.

|

FICA: |

|

|

OASDI

covered wages |

57,600.00 |

|

OASDI

employee contribution rate |

6.20% |

|

OASDI

employer contribution rate |

6.20% |

|

Maximum

OASDI employee contribution |

3,571.20 |

|

Medicare

covered wages |

135,000.00 |

|

Medicare

employee contribution rate |

1.45% |

|

Medicare

employer contribution rate |

1.45% |

|

Maximum Medicare

employee contribution |

1,957.50 |

|

|

|

|

UCRP: |

|

|

UCRP wage

base |

57,600.00 |

|

UCRP

contribution rate |

|

|

FICA

coordinated within UCRP wage base |

2.0% |

|

FICA

coordinated above UCRP wage base |

4.0% |

|

Not

coordinated with FICA |

4.5% |

|

|

|

|

SAFE HARBOR: |

|

|

Safe Harbor

wage base |

57,600.00 |

|

Safe

harbor contribution rate |

7.5% |

|

Maximum

Safe Harbor contribution |

4,320.00 |

EXEMPTIONS TABLE

Effective 1/1/93

Refer to the following table for the federal

exemption amount:

|

|

Value of One FEDERAL Exemption |

Value of One STATE Exemption |

|

Annual |

$2,350.00 |

$1,000.00 |

|

Monthly |

195.83 |

83.00 |

|

Bi-Weekly |

90.38 |

38.00 |

FEDERAL INCOME TAX WITHHOLDING

RATES

Biweekly Employee

|

Single Person – including Head of Household: |

Married Persons: |

||||||

|

If the amount of wages (after subtracting withholding

allowances) is: |

The amount of income tax to be withheld shall be: |

If the amount of wages (after subtracting withholding

allowances) is: |

The amount of income tax to be withheld shall be: |

||||

|

Not over $97.00...............$0 |

Not over $238.00…………$0 |

||||||

|

Over - |

But Not Over - |

|

Of Excess Over |

Over - |

But Not Over - |

|

Of Excess Over |

|

$97 |

__$902 |

15% |

__$97 |

$238 |

__$1,567 |

15% |

__$238 |

|

$902 |

__$1,884 |

$120.75 plus 28% |

__$902 |

$1,567 |

__$3,125 |

$199.35 plus 28% |

__$1,567 |

|

$1,884 |

|

$395.71 plus 31% |

__$1,884 |

$3,125 |

|

$635.59 plus 31% |

__$3,125 |

Monthly Employee

|

Single Person – including Head of Household: |

Married Persons: |

||||||

|

If the amount of wages (after subtracting withholding

allowances) is: |

The amount of income tax to be withheld shall be: |

If the amount of wages (after subtracting withholding

allowances) is: |

The amount of income tax to be withheld shall be: |

||||

|

Not over $210.00...............$0 |

Not over $517.00…………$0 |

||||||

|

Over - |

But Not Over - |

|

Of Excess Over |

Over - |

But Not Over - |

|

Of Excess Over |

|

$210 |

__$1,854 |

15% |

__$210 |

$517 |

__$3,396 |

15% |

__$517 |

|

$1,954 |

__$4,081 |

$261.60 plus 28% |

__$1,954 |

$3,396 |

__$6,771 |

$431.85 plus 28% |

__$3,396 |

|

$4,081 |

|

$857.16 plus 31% |

__$4,081 |

$6,771 |

|

$1,376.85 plus 31% |

__$6,771 |

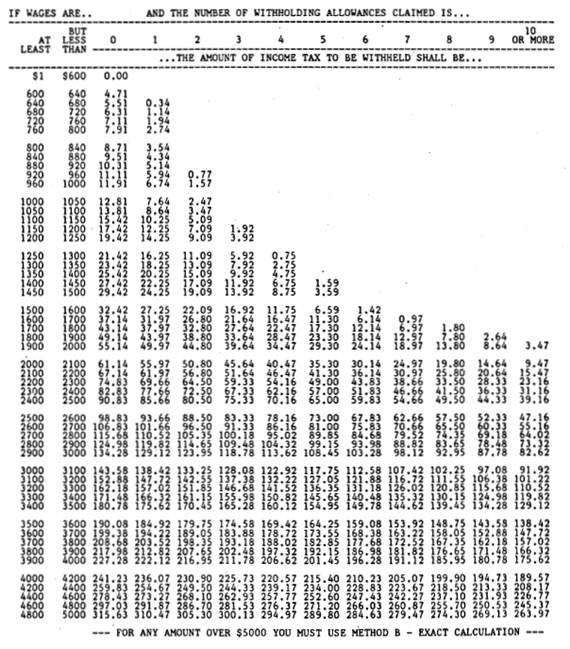

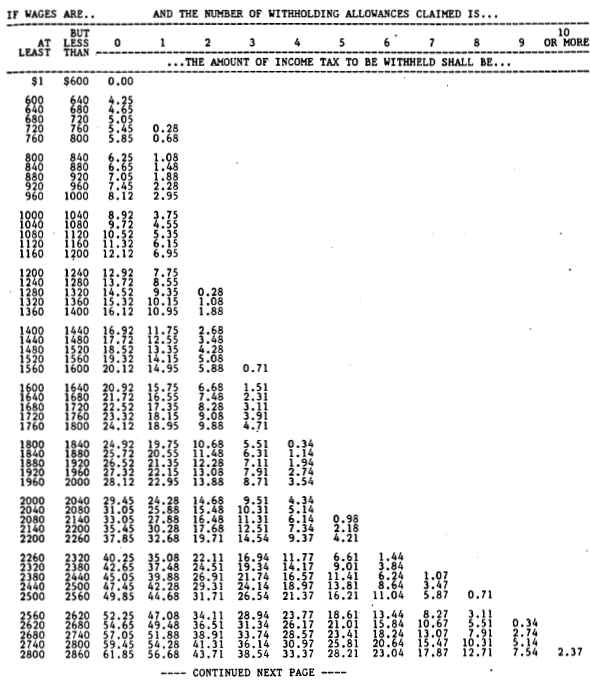

SUPPLEMENT

II

CALIFORNIA STATE

INCOME TAX WITHHOLDING RATES

Effective January 1, 1991

INSTRUCTIONS:

MONTHLY

RATED EMPLOYEES:

EXAMPLE:

A married employee, earning

$4,467 per month, with $50/month tax shelter. Employee has spouse and two

children, also claims three allowances for itemized deductions. Spouse

not working.

4 Exemptions for family

members, Form UCW-4, Line 2A

3 Allowances for

itemized deductions, Form UCW-4, Line 2B

7 Exemptions on Form

UCW-4, Line 2C

Step 1:

From the taxable gross

(after deducting tax shelter, TSP, retirement) deduct $83.00 for each

withholding allowance claimed on line “2B” of the Form UCW-4 to obtain the

adjusted taxable gross.

$4,467.00 Total Gross

(

70.34)

Retirement Reduction

( 50.00)

Tax Shelter Savings

4,346.66

Taxable Gross

( 581.00)

$83.00 x 7 Exemptions

3,765.66

Adjusted Taxable Gross

Step 2:

Determine

regular exemptions from Form UCW-4, Line “2A”.

Form UCW-4, Line 2A = 4 exemptions

Step 3:

Using the appropriate

State table for marital status and pay period, seed the adjusted taxable gross

range (determined in Step 1 above) in the two left columns.

|

|

|

NUMBER

OF WITHHOLDING ALLOWANCES CLAIMED |

||||

|

|

|

|

|

|

|

|

|

$3,700 |

$3,800 |

112.99 |

107.82 |

90.94 |

85.77 |

80.60 |

Step 4:

In the same table refer

to the column for the corresponding regular exemptions (See Step 2) to obtain State

Withholding Tax.

4 Withholding Allowances = $80.60

HOURLY

RATED EMPLOYEE:

Use

the same procedures as above, except deduct $38.00 for each deduction in Item

1.

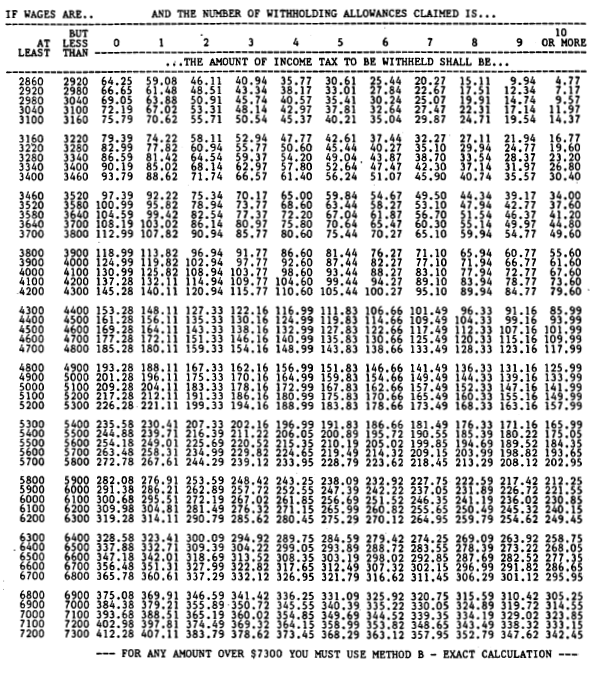

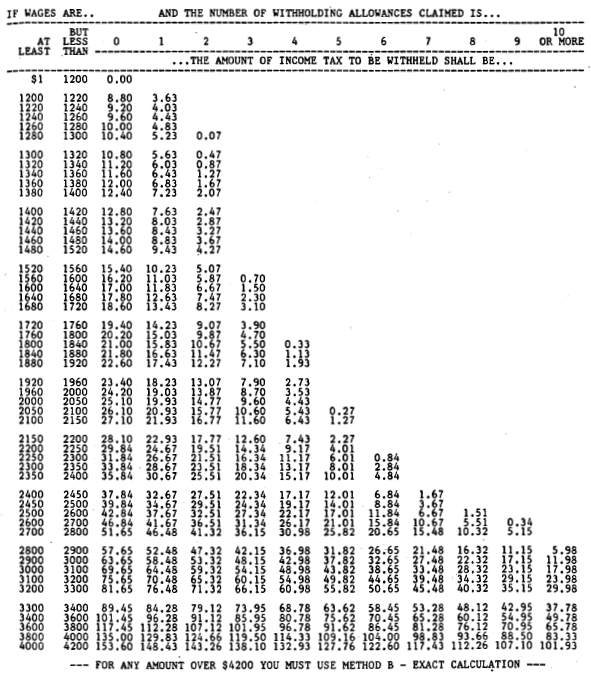

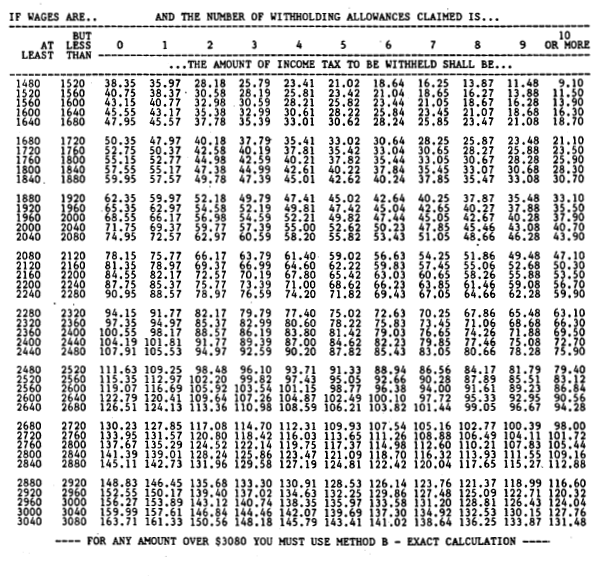

CALIFORNIA STATE INCOME TAX WITHHOLDING RATES

MONTHLY PAYROLL PERIOD

SINGLE PERSONS

DUAL INCOME MARRIED OR MARRIED WITH MULTIPLE

EMPLOYERS

MONTHLY PAYROLL PERIOD

MARRIED PERSONS

MONTHLY PAYROLL PERIOD

MARRIED PERSONS (Cont)

MONTHLY PAYROLL PERIOD

UNMARRIED HEAD OF HOUSEHOLD

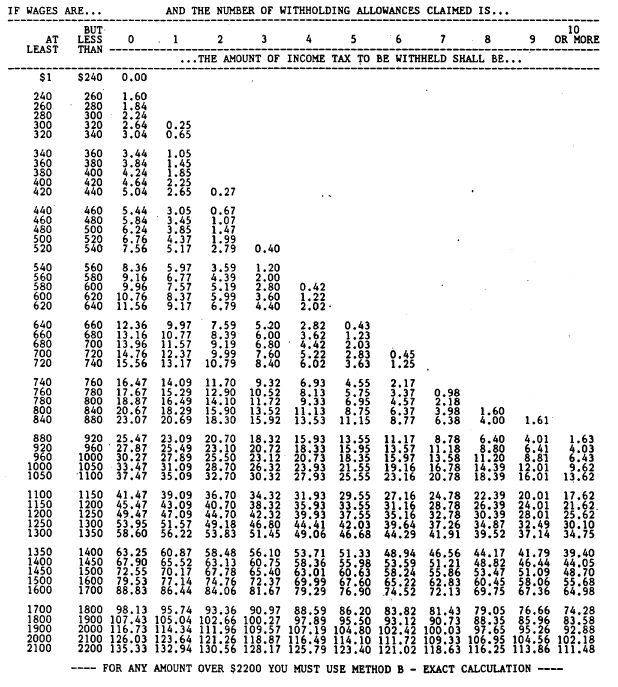

BIWEEKLY PAYROLL PERIOD

SINGLE PERSONS

DUAL INCOME MARRIED OR MARRIED WITH MULTIPLE

EMPLOYERS

BIWEEKLY PAYROLL PERIOD

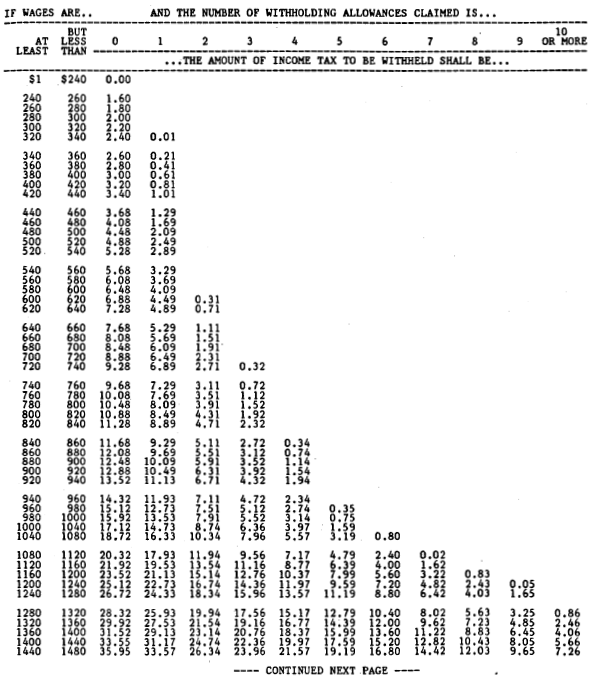

MARRIED PERSONS

BIWEEKLY PAYROLL PERIOD

MARRIED PERSONS (Cont)

BIWEEKLY PAYROLL PERIOD

UNMARRIED HEAD OF HOUSEHOLD