Section: 522-3

Effective: 10/27/1992

Supersedes: 05/03/1976

Issuance Date: TBD

Issuing Office: CAMS (Campus Asset Management System)

PPM 522-3 Exhibit A [pdf format]

PPM 522-3 Exhibit B [pdf format]

PPM 522-3 Exhibit C [pdf format]

RE-UTILIZATION/DISPOSAL OF EXCESS MATERIAL

I. REFERENCES

A. Business and Finance Bulletin (BFB)

BUS-38 Disposal of Excess Material and Transfer of Federally-Funded University-Owned Material

A-51 Application of Proceeds from the Sale, Trade-In, or Transfer of University Property

B. UCSD Policy and Procedure Manual (PPM)

300-20 Sub-Cashiering and Change Funds

522-1 Property Inventory Control System Operating Procedures

C. Accounting Manual

R-216-62 Recording Proceeds from the Sale, Trade-In or Transfer of University Property

II. POLICY

A. This policy provides guidelines to departments or operating units concerning the reutilization/disposal of property owned by The Regents of the University of California. It does not apply to federally-owned property in the control of The Regents. (See PPM 522-1, paragraph XIII, concerning federally-owned materiel.)

Departments or operating units having excess/surplus equipment and materials are encouraged to declare them excess and permit the Equipment Management Division to relocate the items in one of the following ways:

1. Sell the equipment or material to another campus department.

2. Sell the equipment or material to another UC campus.

3. Sell the equipment or material by public sale.

This policy is not concerned with the trade-in of equipment or material to a vendor for credit on a new purchase. This area is covered in PPM 522-1 Section XII.A.

III. DEFINITIONS

A. For the purpose of this policy, the following terms have special meaning:

1. University Material: Equipment or material unconditionally owned by The Regents.

2. Sale: The conveyance of property between departments or campuses with an exchange of funds, or to an individual or organization outside the University for cash or money equivalent.

IV. PROCEDURES

A. Determination and Reporting of Excess Material

1. Department

a. Department chair or head shall determine when University material has no further value to the department and can be disposed of as excess material.

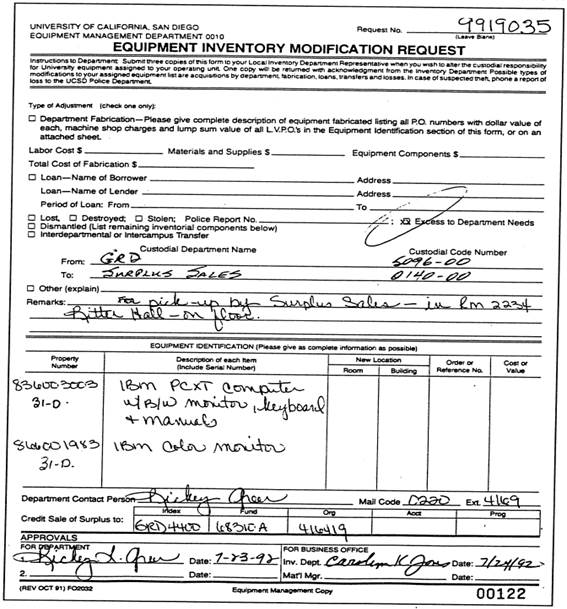

b. The department or operating unit declaring material excess will complete and Equipment Inventory Modification Request (EIMR), Exhibit A, and forward it to the Equipment Management Division of Materiel Management. The EIMR should indicate the condition of the equipment or material and nay include the suggested selling price. No sale will be consummated without the prior approval of the Materiel Management Department.

If the material to be sold is inventorial, the property number assigned must be shown on the EIMR. An EIMR is the only way an inventorial item may be deleted from departmental inventory records.

c. If the department or operating unit declaring equipment or material excess is aware of potential users or buyers, this information should be forwarded with the EIMR.

2. Materiel Management

a. If the excess material has an individual or per lot value currently estimated at $10,000 or more, all other campuses must be given an opportunity to purchase it before it is placed on public sale. This requirement, however, does not apply to the disposal of automotive equipment.

b. Usable equipment and materials will be held for 30 days by Surplus Sales for purchase by University departments.

c. Items not sold within 30 days will be disposed of by methods deemed appropriate by the Materiel Management department.

B. Methods of Disposal to the Public

Disposal may be made by the following methods:

1. Public sale to the highest bidder.

2. Public sale on a "first come, first served" basis if a fair market value has been established by the Materiel Manager and the availability and price of the item(s) are made known to the general public through newspaper advertising and/or other announcement.

3. Private sale to an individual when the cost and effort involved in arranging for a sale by methods 1. or 2. would be disproportionate to the return expected, and the Materiel Manager has determined that the sale price is reasonable.

4. Donation of excess material to an organization outside the University if the market value of the excess material is below the costs required for handling, record keeping, storage, and other costs associated with trade or sale; and either the specific prior review and approval of the General Counsel has been secured, or the General Counsel has given blanket approval for donation of specific categories of excess material to educational institutions, other government bodies, or non-profit organizations.

5. Disposal of firearms requires special handling based on the Code of Federal Regulations, part 178 of 27CFR.

C. Accounting for the Sale of Excess Material

1. a. Sale to another department on campus of excess/salvage material will be accomplished through the use of a Financial Journal prepared by Materiel Management/Surplus Sales.

b. The department acquiring the material will receive a debit to its account for the agreed-upon sales price. The department selling the material will receive a credit for the agreed-upon sales price less the Equipment Management and Committee on Research factors discussed in C.5., below. Exhibit B contains a diagram for determining the account to be credited.

2. a. Sale to another campus of excess/salvage material will be accomplished through use of a Recharge Form. Surplus Sales will complete the Recharge Form and forward it to the Accounting Office for processing.

b. The campus acquiring the material will receive a debit to its account for the agreed-upon sales price. The department selling the material will receive a credit for the agreed-upon sales price less the Surplus Sales and Committee on Research factors discussed in C.5., below. Exhibit B contains a diagram for determining the account to be credited.

3. Sale to an individual or organization outside the University will be processed as follows:

a. Surplus Sales will use Exhibit C to notify the selling department of its credit for the sales price less the Equipment Management and Committee on Research factors discussed in C.5., below.

b. Exhibit B contains a diagram for determining the account to be credited.

4. Sales proceeds credited to fund 68310 may be carried forward for one fiscal year. Balances remaining after that time will be transferred to General Funds and lapsed.

5. a. Surplus Sales is authorized to recover from the proceeds of any sale all specific costs such as long-distance telephone calls and postage. A fee to recover Equipment Management's general administrative costs is also authorized. The fee will be 25% of sale proceeds but shall not exceed $500.00

b. Normally, an additional 10% of the sale of excess equipment and material originating in Instructional and Research departments will be allocated to the Committee on Research for use in furtherance of internal research efforts.

V. RESTRICTION

Special procedures are required to sell property to which the University holds conditional title. (Conditional title reserves to the transferor (title holder) the right to revoke transfer of title, to receive the proceeds of any subsequent sale, or to acquire an interest in replacement.) Generally, departments should obtain unrestricted title to property before it is declared excess for disposal.

VI. Limitation of Sales to Certain Employees and Their Near Relatives

A. No one employed in a Materiel Management department, or a near relative of such employee, may buy excess material either directly or through a public sale.

B. No one employed in a department originating excess material, or a near relative of such employee, may but excess material originating in that department either directly or through a public sale.

C. The principal driver of a University-owned motor vehicle, or a near relative of such employee, may not buy such motor vehicle either directly or through public sale.

Near relative is defined as husband, wife, mother, father, daughter, son, sister, brother, and step-relatives and in-laws in the same relationships. Exceptions to this provision must be approved only by the Vice Chancellor-Administration.

VII. RESPONSIBLITIES

A. Department Chair or Head

Determine those items which will be declared excess and direct preparation of proper forms. Supply all agency approvals for the sale of equipment/material not owned by the University as required.

B. Materiel Management

1. Determine that the University can legally sell the equipment/material declared excess.

2. Make arrangements for pick-up of equipment or material declared excess.

3. Process all necessary paperwork to relocate or dispose of the equipment/material declared excess.

C. Accounting

Review and ascertain the correctness of the disposal entries.

VIII. SPECIAL PROVISIONS FOR TRANSFERS OF UNIVERSITY-OWNED MATERIAL ACQUIRED WITH FEDERAL CONTRACT AND GRANT FUNDS

Recognizing that transferring federally-funded University-owned material is an accepted practice among the academic community, the following special provisions for transferring such material to other education institutions, governmental bodies, or non-profit organizations may be applied. However, under no circumstances whatsoever shall these special provisions apply to material acquired with State general funds.

A. In order to transfer material acquired with federal contract and grant funds to another institution, in conjunction with a move by a faculty member to that institution, the following conditions must be met:

1. The material must be available for transfer: its title must be vested in the University, and the terms of the grant or contract from which it was funded do not prohibit such transfer to another institution.

2. A written request to transfer the material must be made by the department faculty member and must include the following:

a. A specific list of the material including (at a minimum) property numbers, descriptions, original unit costs, and original funding sources/agencies.

b. The reason for the transfer.

c. Name of the institution to which title will be transferred.

d. Justification for transferring rather.than leaving or selling the material.

3. The request must be approved by each of the following:

a. Department head.

b. Dean.

c. Equipment Manager (or equivalent) - verifies that title vests in the University and that there are no restrictions to transfer.

d. Director of Sponsored Projects (or equivalent).

4. Transfers of material with a total historical cost in excess of $100,000 must be approved by the Vice Chancellor-Administration, the Senior Vice President Administration. Requests for material transfer shall not be divided to avoid this requirement.

5. The recipient institution must agree, in writing, to accept title, with the understanding that the material is for the initial use of the new faculty member. This agreement may be obtained via a standard acceptance form signed by an appropriate officer of the recipient institution.

B. The Equipment Manager (or equivalent) shall verify that all required approvals (as indicated in A above) have been obtained and shall approve the release of the material from custody.

C. Unless specific provisions are made in the terms of a contract or grant, transfers of material to individuals or for-profit organizations are prohibited.

Exceptions to the provisions of Section VIII. herein must be approved by the Senior Vice President-Administration. This authority to approve exceptions may be re-delegated by the Chancellor only to the Vice Chancellor-Administration.

EXHIBIT A

EXHIBIT B

DECISION DIAGRAM-SALE OF UNIVERSITY

PROPERTY TO CAMPUS DEPARTMENT OR ANOTHER UC CAMPUS

Does University Have

Unconditional Title? no

Did Agency Specify Credit to Existing Fund?

Did Agency Request no a Refund?

yes yes yes

Record as Expense Record as Sundry

Was Property Acquired

with Federal Funds yes

Credit to Federal

Fund

Is Fund or Follow-On

Fund Still Active?

Payable

yes Record as Expense

Credit to

Federal Fund

no no

Record as Expense

Credit to

Fund 68310

Was Property Acquired with State Funds or Used by State or General Fund programs or activities?

no

yes

Record as Expense

Credit to

Fund 68310

Was Property Acquired Record as Expense with Funds of a Self yes Credit to Self- Supporting Activity?* Supporting Fund

no

Is Fund Used for

Acquisition Known? yes

Is Fund Still yes

Active?

no

Record as Expense

Credit to Fund

Record as Expense Credit to Fund

68310

*Self-supporting activities include UNEX, fund 20300, and recharge/sales operations normally accounted for in fund range 60300 through 76999.

EXHIBIT C

To:

From: Surplus Sales

Reference: Distribution of Income from Disposal Sale # _____ Proceeds from Disposal Sale # __________________ totaled$

To: Department $______________________

Inventory Division $_________

Committee on Research $__________________________

Total $

The department's share of the proceeds will be credited to account(s):

6-

6-

6-

The items sold were:

Property# Description Reference#

EFFECTIVE DATE:

SUPERSEDES DATE: