Section: 522-4

Effective: 07/10/1989

Supersedes: 04/01/1986

Issuance Date: TBD

Issuing Office: CAMS (Campus Asset Management System)

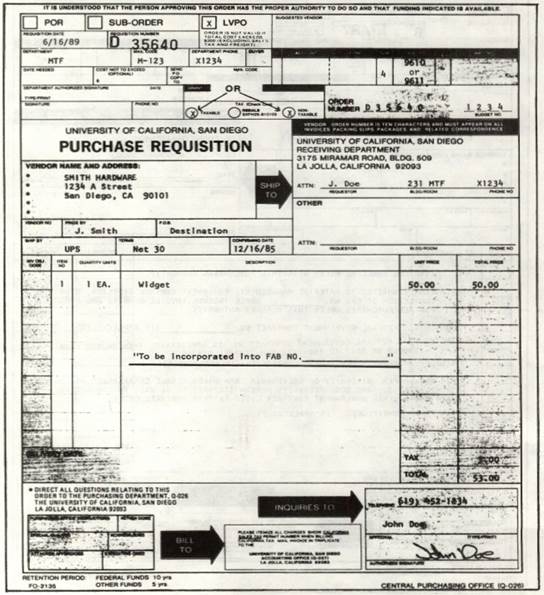

PPM 522-4 Exhibit A [pdf format]

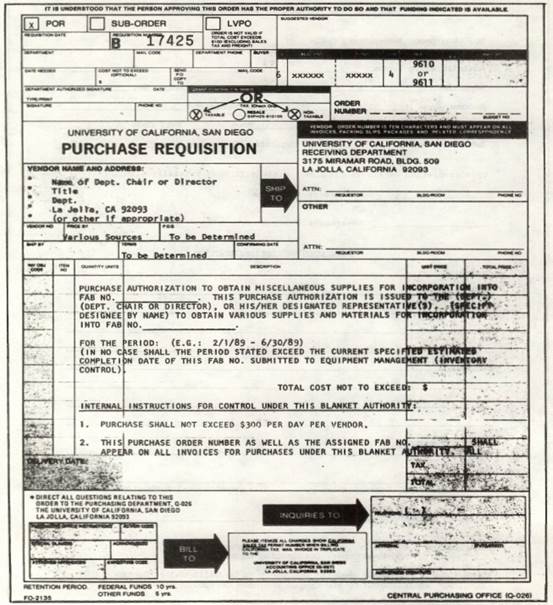

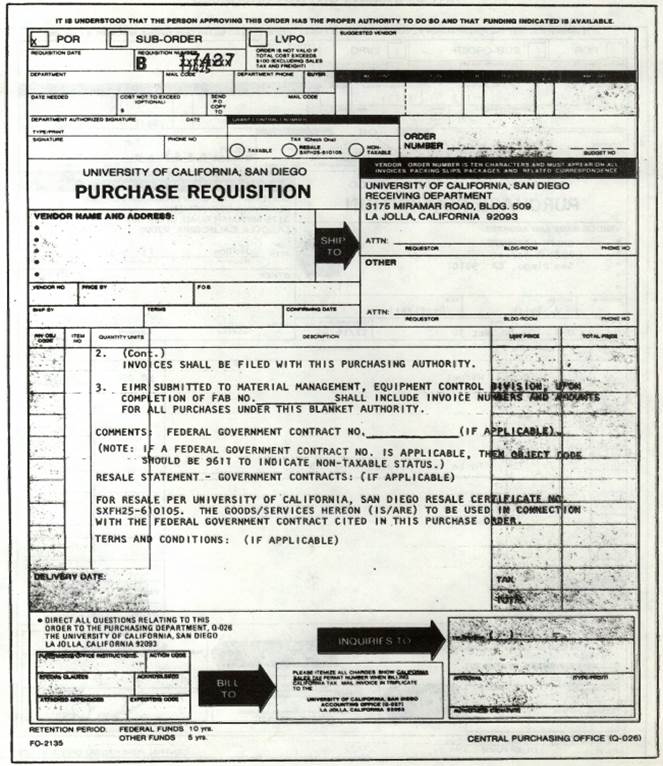

PPM 522-4 Exhibit B [pdf format]

PPM 522-4 Exhibit C [pdf format]

FABRICATED EQUIPMENT

I. REFERENCES

A. University of California Accounting Manual

P-415-32 Plant Accounting: Inventorial Equipment - Fabricated Items

B. University of California Business & Finance Bulletin

BUS 29 Management and Control of Inventorial Equipment

C. UCSD Policy and Procedure Manual (PPM)

150-14 Provision for Indirect Cost Recovery on Federal and Non-Federal Supported Programs

523-5 How to Complete a Purchase Order Requisition Form

D. UCSD Cost Accounting Standards Board Disclosure Statement (CASB DS-2), June 30, 1998

E. OMB Circular A-21, Cost Principles for Educational Institutions (Revised), May 8, 1996

II. POLICY

Office of the President Administration and Federal policies specify accounting and audit procedures covering inventorial items of fabricated equipment. This policy outlines campus procedures for recording and reporting fabricated equipment in order to satisfy those requirements.

III. DEFINITIONS

A. Fabricated Equipment

1. An item of non-expendable, tangible, personal property, physically constructed by a campus activity which has a total acquisition cost of $500 or more, and has a normal life expectancy of two years or more. Usually, various off-the-shelf equipment components, materials, and supplies are incorporated in such equipment.

2. The term “FAB” (fabricated, fabrication) as used in this policy does not include equipment fabricated for the sole purpose of sale and delivery to an outside activity under a specific contract for services handled through the Business Office.

B. Equipment Components

1. “Off-the-Shelf” items of non-expendable, tangible, personal property which have an acquisition cost of $500 or more per unit and a normal life expectancy of two years or more. Generally, power supplies, meters, motors, TV cameras, recorders, counters, etc. fall into this category.

C. Materials and Supplies

Items which are incorporated into a FAB such as software, capacitors, resistors, connectors, nuts, bolts, wire racks, panels, fittings, etc.

IV. PROCEDURES

A. Initiating, Recording, Reporting, and Accounting for Equipment Fabrications

1. Departments should initiate a Request for Issuance of Fabrication Number form, Exhibit A. It should be signed by the authorized individual who will administer the FAB. Required information includes description of the item to the extent known; location, name and account number of the department that is to have custodial responsibility; the estimated value of the FAB; and the estimated completion date. Title and tax status should be appropriately indicated based on where title is to initially vest upon completion of the fabrication. Generally, title passes to the University unless it is specifically stated in the contract that the Federal Government retains title. The Office of Contract and Grant Administration (OCGA) Award Distribution Slip will indicate the taxable status of equipment for each award. Please note that it is the responsibility of the department via OCGA to obtain sponsoring agency approval of the fabrication when required.

2. Equipment Management will issue a FAB Number, and return a copy of the Request (with the FAB Number assigned) to the initiating department. The FAB Number becomes the control number and is to be referenced on all documents relating to the project, and will be used only for expenditures relating to the particular FAB.

3. When recording the fabrication of equipment, all materials, supplies, and services from outside vendors or authorized recharge activities used in the FAB should be object coded 9610 or 9611. These costs are excluded from the indirect cost rate.

4. Departmental labor, travel, or other operating expenses associated with the FAB should be coded with the object codes normally used for such expenses. These expenses are subject to the indirect cost rate.

5. Upon completion of a FAB, the custodial department will submit an Equipment Inventory Modification Request (EIMR) form to Equipment Management with a complete description of the item and its location. The total value should be summarized with purchase order numbers, recharge activities, labor, travel and operating expenses, each with applicable costs.

6. Upon receipt of the EIMR, Equipment Management will record the fabricated item on the custodial department's equipment inventory listing, and if not previously assigned, issue a property number which will close out the FAB.

7. An interim and updated EIMR is required annually on the anniversary date of assignment of the FAB number until the FAB is closed out (i.e., final EIMR submitted). The first and all subsequent interim EIMR's should include an updated completion date in addition to data elements as outlined in item 5 above. Upon receipt of the first interim EIMR, Equipment Management will assign a property number to the FAB and record the FAB Number on the custodial department's equipment inventory listing. The FAB Number will be substituted with the proper nomenclature upon completion of the FAB.

8. If the fund number applying to a particular FAB changes or additional fund numbers are added before FAB close out, the cognizant department will notify Equipment Management by memo of this change.

B. Purchase of Equipment Components, Materials and Supplies for Fabricated Equipment Items

1. The Purchase Order Requisition (POR) is the procedural mechanism utilized to purchase equipment components, materials and supplies from outside vendors to be incorporated into a FAB. The POR must include the notation “to be incorporated in FAB No._____________”; it is coded Subaccount 4, Object Code 9610 or 9611.

2. Fabrication Blanket Order

Authorized departmental personnel may submit a Purchase Order Requisition, Exhibit B, to their appropriate Purchasing Office for approval of a “Fabrication Blanket Order”. After review and approval, a “Fabrication Blanket Order” will be issued. Purchases up to $300 per vendor per day for supplies and materials to be incorporated into the particular FAB can then be made during the period specified on the order, using this Blanket Order number. Use of the Fabrication Blanket Order is entirely at the discretion of the department and is issued in the Chair or Director's name.

3. Low Value Purchase Order (LVPO)

Authorized department personnel may use the LVPO to purchase supplies and materials to be incorporated into the FAB in lieu of the Fabrication Blanket Order when supplies and materials purchased fall within the criteria of the low value purchase authorization. However, it is essential in such cases, that the LVPO include a statement “to be incorporated into FAB No.__________”; that it be coded Subaccount 4, Object Code 9610 or 9611, Exhibit C. Use of the LVPO is entirely at the discretion of the Department.

4. Equipment Purchases

Items of equipment, as defined in Section III.B., Equipment Components, to be incorporated into a FAB, are to be purchased in accordance with purchasing procedures as indicated in PPM 523-5. They must be identified as items “to be incorporated into FAB No._____________” , and will be coded Subaccount 4, Object Code 9610 or 9611.

5. Taxability

Equipment Management will verify the correct tax status of all Purchase Order Requisitions for fabricated equipment.

C. Note: LVPOs and PORs should be annotated “non-taxable” i.e., not subject to the application of sales or use tax, if title to the FAB is to initially vest with the Federal Government.

EXHIBIT A

EXHIBIT B

FABRICATION BLANKET ORDER FORMAT

EXHIBIT C

LVPO FORMAT FOR FAB PURCHASES