Section: 410-1

Effective: 01/07/1977

Supersedes: 02/16/1971

Next Review Date: TBD

Issuance Date: 01/07/1977

Issuing Office: Office of University Development and Office of Donor Stewardship

PPM Exhibit A [pdf format]

PPM Exhibit B [pdf format]

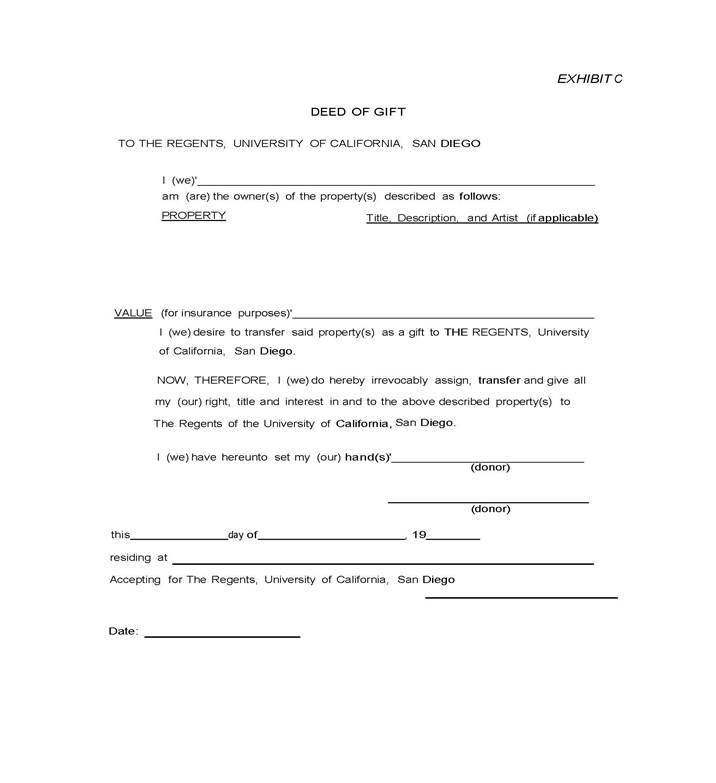

PPM Exhibit C [pdf format]

SOLICITATION, ACCEPTANCE, AND ADMINISTRATION OF GIFTS TO THE UNIVERSITY

I. REFERENCES

A. California State Constitution.

B. By—Laws and Standing Orders of The Regents.

C. Delegations of Authority, PPM 10—5 and Supplement VII.

D. Policy and Procedure Manual for Gifts and Endowments.

E. Policy and Procedure Manual for Contracts and Grants.

II. RELATED POLICIES

UCSD Policy and Procedure Manual (PPM)

150—33 Patent Policy

410—2 Solicitation, Acceptance and Administration of Gifts to the UC San Diego Foundation

III. AUTHORITY

In Article IX, Section 9, of the California State Constitution The Regents of the University of California, a California public corporation, is empowered:

“...to take and hold, either by purchase or by donation, or gift, testamentary or otherwise, or in any manner, without restriction, all real and personal property for, the benefit of the University or incidentally to its conduct.”

Except as provided in Standing Order 100.4 (cc), gifts or grants offered to the University, or to the Corporation for the benefit of the University shall be accepted only by the Board or with its express authority.

The California State Constitution empowers The Regents to delegate to others such authority or functions as The Regents may deem necessary. Pursuant to this authority, the regental corporation has delegated to the President certain authority with regard to solicitation, acceptance, and administration of gifts. Also pursuant to the Standing Orders of The Regents, the President is empowered to delegate most of his duties provided for therein; thus by memorandum of July 23, 1976, the President delegated to Chancellors, and Vice Presidents, the Dean of University Extension, and the University Dean of Agriculture certain authority with regard to solicitation, acceptance, and administration of gifts.

IV. POLICY

It is the policy of the San Diego Campus and the Office of Development to record all gifts received from individuals and other sources directly to The Regents, to issue appropriate receipts and/or acknowledgements to the donors, to officially accept such gifts or private grants on behalf of The Regents, to initiate and maintain such records as will clearly set forth the designation and restriction of each gift, and to ensure compliance with the provisions of each gift.

V. PROCEDURES

A. Types of Gifts

The University receives gifts of many different types because of the multiplicity of its activities. Uniqueness, per se, is not a deterrent to acceptance if the nature and terms of the gift are appropriate to the purposes of the University. The most common types and salient points which are peculiar to the recording and reporting of the various types of gifts (more expressly defined in Exhibit A) are listed below;

1. Monetary (currency, coin, checks, money orders, bank drafts, etc.).

2.* Securities (stocks and bonds).

3* Gifts—in—Kind.

4* Pledges.

5. Real Property.

6. Inventions and Patents.

7. Mineral Rights.

8. Fractional or Remainder Interests.

9. Life Income Plans.

10. Bequests and Devises.

NOTE: Gifts preceded by an asterisk(*) are covered in this procedure. For information on processing other types of gifts, contact Office of Development.

1. Monetary

In regard to gifts of currency, coin, checks, money orders, bank drafts, etc., special precautions should be taken. CASH should be delivered immediately to the Office of Development on campus or the Planning Office at the UC Medical Center, San Diego. All other checks, bank drafts, money orders, etc., should be forwarded to the Office of Development with proper documentation. (See Exhibit B.)

2. Securities

IMMEDIATELY take to Office of Development.

As set forth in the By-Laws of The Regents, the Treasurer is the official custodian of all securities belonging to the Corporation (University). The Office of Development should be consulted as to governing procedures for handling gifts of this nature. In the absence of special circumstances, the following procedures normally apply:

Securities issued in the name of the donor should be transmitted to the Office of Development and be accompanied by a stock power signed in blank by the donor and sent in a separate envelope from the stock certificate. In the event the donor wishes to have the stock transferred on the books of the corporation prior to transmittal to the University, please request that the name of the nominee be RUCAL rather than The Regents, University of California. Donors of securities should be requested to provide a guarantee of their signature, either by their bank or broker, at the time of transfer of securities to the University. While most donors will appreciate the necessity of this safeguard, it may be that some will be reluctant to comply. In such case, the stock certificate and/or stock power should be forwarded to the Treasurer’s Office by the Director of Development, certifying knowledge of the donor and the validity of the donor’s signature together with the letter of gift which also would bear the donor’s signature. Securities are valued as of the date they are received on the local campus. (This may not, however, be the amount received by the office, college, department or unit.) This date should be clearly indicated in the campus letter transmitting the securities to the Treasurer’s Office.

3. Gifts—in—Kind

Departments and/or units to have custody of gifts-in-kind should be consulted before this type of gift is accepted, and proposals should be reviewed by the Vice Chancellor—Administration. Special care must be taken to ensure that acceptance will not involve financial commitments in excess of budgeted items, or other obligations disproportionate to the usefulness of the gift. Consideration should be given to cost of maintenance, cataloging, crating, delivery, insurance or display, as well as to space requirements for exhibition or storage.

A fully effective legal transfer of a gift—in—kind, for tax purposes, may be accomplished by a transfer of title by letter or deed—in—gift form (Exhibit C). In addition, the property must be placed under the control of, or in the physical possession of, a duly authorized representative of the University.

For deduction on income tax, the donor may wish to secure a professional appraisal. Because the appraisal is used solely for the benefit of the donor, the University deems the securing of such an appraisal to be the donor’s personal responsibility. The cost for such appraisal by the donor is also deductible on income tax.

Direct involvement of the University in securing appraisals could result in their accuracy and objectivity being challenged by the Internal Revenue Service. Thus it is in the donor’s best interest that the University neither provide directly nor be responsible for securing the services of an appraiser in connection with gifts to the University.

For internal administrative purposes only, it is appropriate to have a qualified member of the University’s staff estimate a gift’s value. Such an estimate should approximate, as nearly as possible, the market value, and is a useful guide in establishing inventory control and in determining appropriate handling, custody and insurance.

4. Pledges

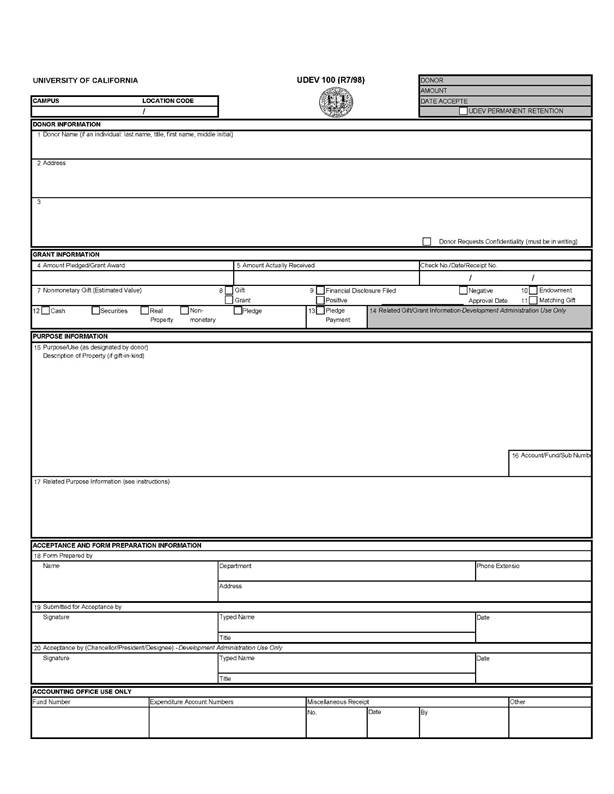

May be accepted in the same manner and under the same conditions as a gift, and are to be reported on Form UDEV100 (Exhibit B).

NOTE: Pledges do not represent an appropriate source of funding for purposes of bid solicitation and contract award in connection with construction projects. Reliance on donor’s pledge payments to meet actual construction costs in fulfillment of contractual agreements has been deemed impracticable. Additionally, commitments against non-constructive pledges must be specifically approved by Vice Chancellor-Administration.

5. Real Property

Contact the Office of Development.

Authority to accept real property has not been delegated by The Regents.

6. Inventions and Patents

Contact the Office of Development.

Generally, the assignment of an invention as a gift is not accepted unless the invention is considered patent able and marketable. The assignment of a patent as a gift is not accepted unless the patent has a potential market. The acceptance of an invention or a patent may not be considered until the Patent Administrator of the University has been consulted and the Board of Patents has determined the possible novelty and commercial potential.

Disposition of any net income accruing to The Regents from inventions or patents received as gifts shall be made in accordance with the UCSD Patent Program (see PPM 150-33).

7. Mineral Rights

Contact the Office of Development.

The General Counsel’s Office will be contacted on all gifts involving the acceptance of mineral rights, i.e., gifts involving oil or gas wells, full or fractional interests in mineral rights, or royalties accruing from producing wells or mines, and will be supplied with a detailed description of the proposal and, if possible, a legal description of the interests involved.

8. Fractional or Remainder Interests

Contact the Office of Development.

The University may accept gifts of fractional interests in personal and real property, such as paintings, jewelry, collections of various kinds, tenancies-in-common, leaseholds, and other temporary or limited interests and remainders.

9. Life Income Plans

Contact the Office of Development.

Life Income plans are acceptable by the University but must be reviewed and approved by the General Counsel.

10. Bequests and Devises

Contact the Office of Development.

It is the responsibility of the General Counsel to follow administration of all estates in which the University has an interest. At the time of distribution from an estate, only the Treasurer and Assistant Treasurer are authorized to execute the necessary receipts in behalf of the University.

B. Refusal of Gifts

Gifts should be refused when the purpose:

1. Is inappropriate for or inimical to the best interests of the University;

2. Is clearly a commercial endeavor; or

3. Would obligate the University to undertake responsibilities, financial or otherwise, which it may not be capable of meeting for the period required by the terms of the gift.

C. Agency Funds

From time to time the University receives monies from non-University entities such as groups of students, faculty, staff and Governmental and private organizations or activities for which the University provides a fiscal agency service. The University in accepting funds for the deposit and disbursements from these entities does not exercise any direct fiscal control over their use; this control remains with the activity or the organization. Disbursement and use of these funds are made on specific instructions from the organization. These funds are considered agency funds and are not gifts and are not to be reported on Form UDEV100. The establishment of an agency fund requires approval of the Business Office in coordination with the Accounting Office. As a rule, agency funds are not tax deductible by the payer.

D. Acknowledgements

1. All gifts and private grants should be acknowledged promptly by the department, college, school, office or unit receiving the gift.

NOTE: Acknowledgement of a gift/private grant should never imply acceptance of same.

Acceptance is made by a University official having appropriate delegated authority only. If notification is by hand delivery, prepare document specifying the purpose of the gift.

E. Alumni and Donor Record System

The University has now established a system-wide record system for all campuses of the University. The Office of Development at the San Diego campus is responsible for administration of the Alumni and Donor Record System (ADCORS). Requests for information should be submitted to this office.

1. Reporting

Form UDEV100, Gift/Grant Acceptance Report, (Exhibit B) is the official document for reporting of gifts, private grant and pledges and for gift acceptance.

This form will be completed by each department, school or office receiving gifts, private grants or pledges. The accepting officer whose signature appears on the original of Form UDEV100 must be duly authorized through appropriate delegation channels. (See Supplement VI, Delegation of Authority, Subsection B. Acceptance.) Form UDEV100 for gifts, private grants and pledges and originals of donor communications and copies of acknowledgement letters for gifts should be transmitted to the Office of Development.

2. Documentation

All pertinent information should be attached to the UDEV100 Form and forwarded to the Office of Development, Office of Contract and Grant Administration. Information required to complete gift acceptance is as follows: proposal/solicitation letter, correspondence relating directly to gift/private grant, award letter, acknowledgement letters, and Human Subjects form if applicable.

VI. DELEGATION OF AUTHORITY

A. Solicitation of Gifts

1. Chancellor

Authority to solicit gifts or pledges not in excess of $1,000,000.

2. Vice Chancellor-Administration.

Authority as in 1. above re-delegated from Chancellor.

3. Director of Development

Authority as in 1. above re-delegated from Chancellor.

4. Faculty and Staff

May make informal approaches to individuals, corporations, foundations and other funding agencies for the purposes of determining whether preparation of a formal, written proposal for a specific project is warranted, providing the preliminary estimates of the full cost of the project have been made and the project is otherwise in accord with University policy.

If it has been determined that a formal solicitation is desirable, either as a result of informal discussions or as a result of a specific project, the administrative unit head should be consulted so that he/she may advise the Chancellor in letter from via the Director of Development. Prior to solicitation or acceptance of any gift which is intended to be in support of a construction project, such project must have been approved as evidenced by its inclusion, either initially or by amendment, in the University’s most recently approved Capital Improvement Program, and the proposed gift must be intended for that portion of the project funding which is indicated in said program as coming from non-state sources.

5. Contracts and Grants

If it has been determined that a formal solicitation is desirable, and it comes within the jurisdiction of the Office of Contract and Grant Administration and meets the definitions of a contract or grant as stated in Exhibit A, the proposal should be submitted to the said office in accordance with Section 150 of the UCSD Policy and Procedure Manual.

No contract or grant for research, training, or development may be solicited officially without the prior approval of The Regents or an authorized officer of the University.

B. Acceptance of Gifts

Proffered gifts should be considered from the academic point of view as well as appropriateness to administrative programs and policy. To the extent feasible, gift offers should be reviewed and approved by the head of the appropriate academic or administrative unit. This is particularly desirable when gift offers involve proposals for new programs or projects. In the case of gifts-in-kind, as defined in Exhibit A., (see also V.A.3. Gifts-in-kind,) no acceptance, either direct or implied, is to be stated without the prior approval of the Vice Chancellor-Administration.

The University is legally obligated to adhere to the terms and conditions of every gift. For this reason, accepting officers should consider the terms of each gift with the utmost care to assure that they are feasible, do not unduly hamper the usefulness and desirability of the gift, and are in conformity with University policy. Gifts should not be accepted informally, i.e., verbally, and terms of the gift should be set forth in writing by the donor.

1. Chancellor

Authority delegated by the President to accept pledges and gifts, except those which involve:

a. Amounts in excess of $1,000,000;

b. Construction facilities not previously approved by the Board;

c. Exception to approved University programs, policies and construction projects;

d. Commitment for more than seven years; or

e. Obligation on the part of the University to expenditures or costs for which there is no

established fund source.

f. An interest in real property.

2. Vice Chancellor-Administration

Authority re-delegated by Chancellor with the exceptions as in l.a., b., c., and e. above.

3. Director of Development

Authority redelegated by the Chancellor to accept pledges and gifts, except those which involve amounts in excess of $50,000 and the exceptions as in l.a., b., c., d., e., and f.

4. Administrative Assistant — Office of Development

Authority re-delegated by the Chancellor to accept gifts, pledges not in excess of $1,000.

EXHIBIT A

GLOSSARY AND/OR DEFINITIONS

Acceptance is the formal manifestation of intent to take title to a tendered gift.

Acknowledgement is notification to a donor of receipt of a proffered gift.

Contract is a legal agreement between two or more persons, setting forth in writing terms, costs, and conditions for delivery of specified services, materials, or equipment by one of the parties to the other party for some return performance (consideration)

Gift is a conveyance or transfer of an asset (including cash or negotiable instruments) made gratuitously, without consideration as required in a contract or grant.

Gift-in-Kind is tangible personal property proffered as a gift. There are two categories of a gift-in-kind: (1) those of $100 or more in value which are inventorial, and (2) those which are non-inventorial, or consumable supplies such as chemicals, glassware, etc.

Grant is a simpler form than a contract of bilateral legal agreement between two or more parties which obligates the recipient to provide something or to perform a service of more than incidental significance to the grantor. A grant usually provides for reimbursement for specified costs of basic research or some form of basic investigative effort. Typically, there will be certain restrictions as to: (1) type of research or training which can be initiated under the grant; (2) transfers of funds between cost categories; (3) expenditures requiring prior sponsor approval; (4) what fiscal or technical reports will be required, and (5) patent rights, etc.

Pledge is a promise or commitment to make a gift in the future.

EXHIBIT B - Form UDEV100

EXHIBIT C – Deed of Gift